Attention: We are not FEMA, SBA, or an insurance company. We aim to help you navigate how to apply for and receive aid.

Below are three steps to get you started.

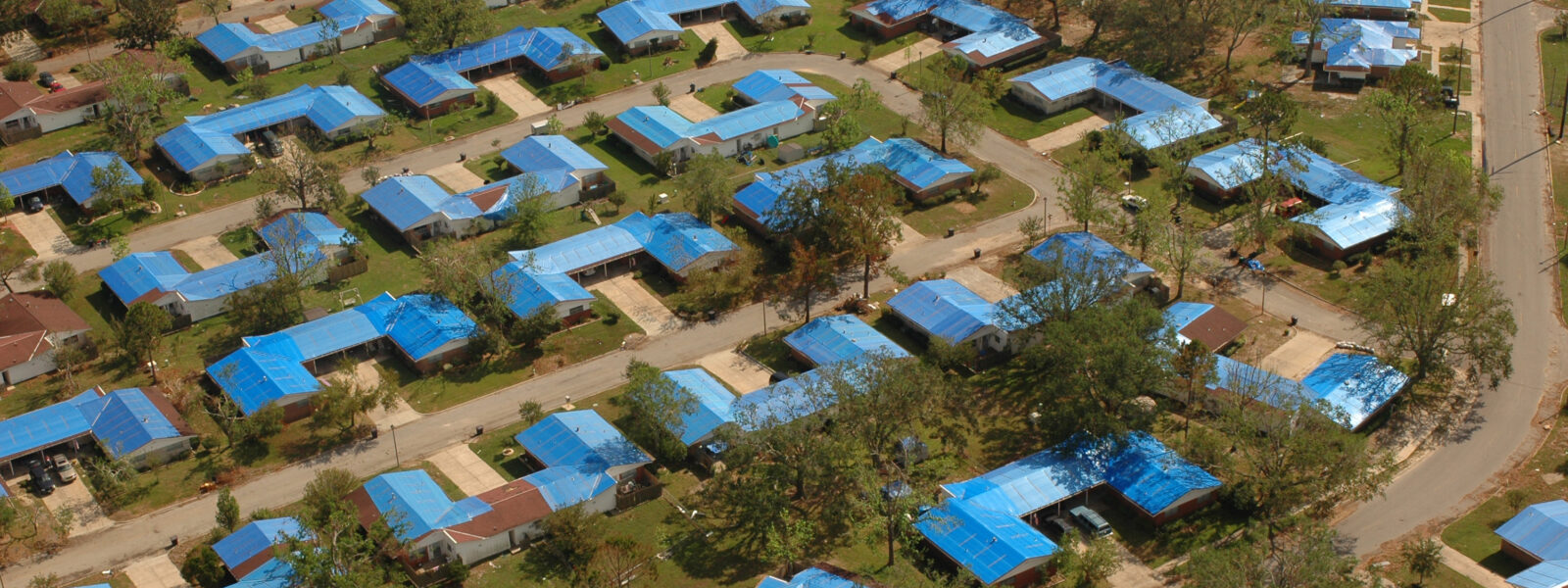

1. Recover and Protect Your Property

Follow these steps from IBHS to safely secure, protect, and begin to repair and rebuild your property after a damaging storm.

2. File Insurance Claims

- File a claim with your insurer for both homeowners and flood insurance. Understand your deductibles. You will be responsible for these costs. Negotiate with your adjuster.

- Use FEMA's How Do I Start My Flood Claim? website to understand the insurance claims, repair, and rebuilding process.

- Use this checklist from FEMA to understand what you need when filing a flood insurance claim and how to negotiate with your insurance adjuster.

- Avoid Fraud - An Assignment of Benefits (AOB) contract will give a contractor your insurance claim. Talk with your insurance company about claims directly. Get three repair quotes in writing on company letterhead. Check for a home builder or roofer state license. Download our Fraud Checklist.

- Re-roof or build to FORTIFIED standards to strengthen your home and be eligible for insurance discounts.

3. Apply for FEMA and SBA Disaster Assistance

- Even if you have insurance, apply for FEMA disaster assistance at www.disasterassistance.gov or call 1-800-621-3362.

- Apply for The Small Business Administration (SBA) loans. Applying for SBA loans can open up additional assistance even if you don't take the loan. SBA loans can also provide additional funding up to 20% of a loan value for rebuilding projects to mitigate your home, including repairs and rebuilding that will meet the FORTIFIED Home™ standard.

- If your home is damaged, do not answer "no" to housing assistance or rental assistance at this time. Those options can be used for temporary housing while you rebuild. By answering no, you may make yourself ineligible for some disaster assistance.